For Private Banking,

Wealth Management,

Investment Banking &

Corporate Finance

Request a Demo

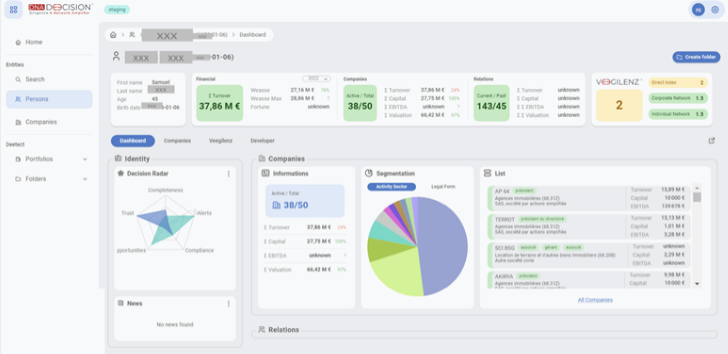

Gain a Deeper Understanding of your Third Parties.

Faster, Deeper, Wider & Continuous

Extend the Boundaries of Common

Due-Diligence

Get a Full 360° View of Clients

(both Individuals and Companies)

with high-quality data

Reasons to Utilize DNA

Operational Advantages

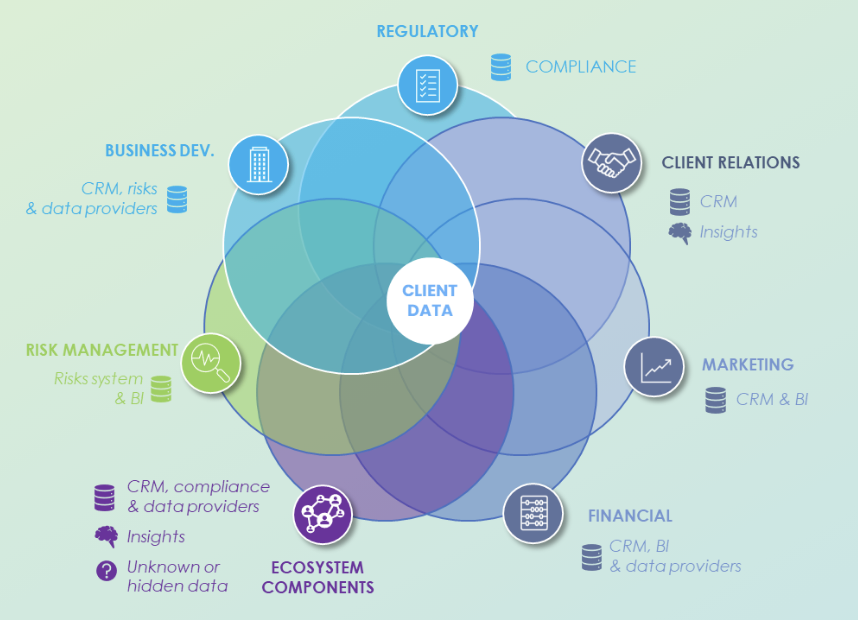

Compliance & Business Performance Reconciled

Automated Early-Stage KYP and KYC

Discover New Clients & Assess their Potential

Portfolio Segmentation with Tailored Built-In Indicators

Automate Time-Consuming Tasks

Client Profiling, Reviews, and Clustering

Includes Predictive Components

Enhance and Structure Collaboration

Among Diverse Teams within an Organization

Across Banking/Financial Group Segments

Quantitative KPIs

Strategic Benefits

© 2023 by Deecision SAS INNITIALL RCS Nanterre B 539 252 981 Capital 155 000 € France